Optimising the Supplier Invoice to Payments Flow

An effective invoice clearance process is key to on-time order completion and delivery. Oracle Fusion Payables Cloud Service offers an integrated solution that will help you track and coordinate supplier invoices across the organisation and also allow you to approve them on the go.

Automate your invoice creation process, reduce processing delays and data errors, and improve efficiency using the Payables imaging solution in Oracle Fusion Payables Cloud Service.

![]()

Consider the following scenarios:

Scenario 1 – Purchase Order is matched to an Invoice with an Overbill.

In this scenario when the purchase order is created, and invoice matched to purchase order (approval level is 2-way). The invoice will automatically go on hold. The hold resolution needs to be followed and then only the invoice will be validated for further process.

Scenario 2 – Automated end to end invoice processing with minimal manual intervention.

In this scenario if an enterprise receives majority of their supplier invoices as physical invoices and an automated solution is required. Oracle’s Integrated Invoice Imaging feature can be used which offers the following features:

- Automated processing of Invoices.

- Flexible Invoice Formats.

- Multiple languages supported.

- No configuration required.

- Separately licensed.

- Ability to pass additional information.

For this, the Manual invoices need to be scanned and sent to an Email address provided by oracle, which will then store it in the Image Repository. The Import Invoices program needs to be run with source as imaging, which will transfer all the invoices from the repository to payables. Also, this can only be done by authorized users.

Scenario 3 – Any invoice which has an invoice amount less than USD 6000 should be automatically approved and any invoice with an invoice amount greater than USD 6000 requires approval by the Finance Approval Groups depending on the Cost centre (100 & 200).

In this scenario approval rules can be set up in such a way that for Invoice amounts less than USD 6000 will be automatically approved and for invoice amounts greater than USD 6000 it will be approved by GRP1 if CC is 100 and GRP2 if CC is 200.

| Business Requirement | Routing Type | Rule Details |

| Invoice amount < USD 6000 | Auto Approve | Invoice amount is less than USD 6000. |

| Invoice amount > USD 6000 |

Group in Serial [For CC 100 – GRP1] [For CC 200 – GRP2] |

Invoice amount is more than USD 6000. |

To know more about Fusion Practices’ Oracle Implementation Services

Manage Supplier Invoices

- Invoice Sources

- Manual – Create Invoices using spreadsheets.

- Automated – Integrated Imaging, Expense Reports, Intercompany

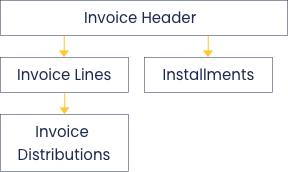

- Invoice Structure

- Invoice Types

- Standard – An invoice from a supplier for goods or services rendered.

- Prepayment – An advance payment to a supplier.

- Credit memo – A document from a supplier that provides a credit for goods or services rendered.

- Debit memo – A credit from a supplier that does not send you a credit memo document.

- Withholding tax – An automatically generated invoice to a tax authority for withholding tax.

- Interest – An automatically generated invoice for interest on overdue invoices.

- Standard invoice request – An invoice without a purchase order that’s submitted through Oracle Fusion Supplier Portal and that’s pending approval from the requester.

- Payment request – A request from Oracle Fusion Expenses or Oracle Fusion Receivables to disburse funds to a payee that is not defined as a supplier in the application.

Approve Supplier Invoices

Various levels of approvals can be set up as per the business requirements based on amounts, chart of accounts segments which will be approved by specified supervisors in the hierarchy.

Resolve Supplier Invoice Holds

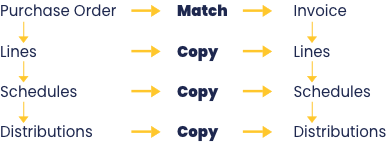

1. Full Matching

2. Match Approval Level

Issue Payments

- Single payments

- Quick – When we create a quick payment you can select an invoice regardless of the payments terms and due date. For example, we can create a Quick payment for an invoice that is not yet due OR when you are making payment through Oracle E-Commerce Gateway.

- Manual – This is the process of entering the check details which has been paid manually in some emergency requirements into the payment form and selecting the invoices of the concerned supplier and check whether the total of the invoices and the paid amount at the header are same and save. In this there will be no formatting and printing process through payables.

- Refund – When a supplier or employee sends you a refund for an invoice payment you have made, you can record the refund in Payables. Here you’re receiving the money from supplier or employee, you are not paying the money to supplier.

- Batch Payments

- Payment Process Requests – A PPR can create multiple payments at single time to multiple suppliers. When a PPR is submitted, the request passes through various stages of processing and withing each stage a request can have a different status.

Types of Payment

- Electronic – To pay your suppliers, you can make payments through electronic funds transfer by transmitting payment files to your bank or payment system.

- Printed – To pay your suppliers, you can make payments by printing checks.