Oracle Fusion Tax:

A centralised solution for global tax needs

Looking for a single point solution that supports simple and complex country-specific tax requirements? Oracle Fusion Tax may just be the solution that suits your needs.

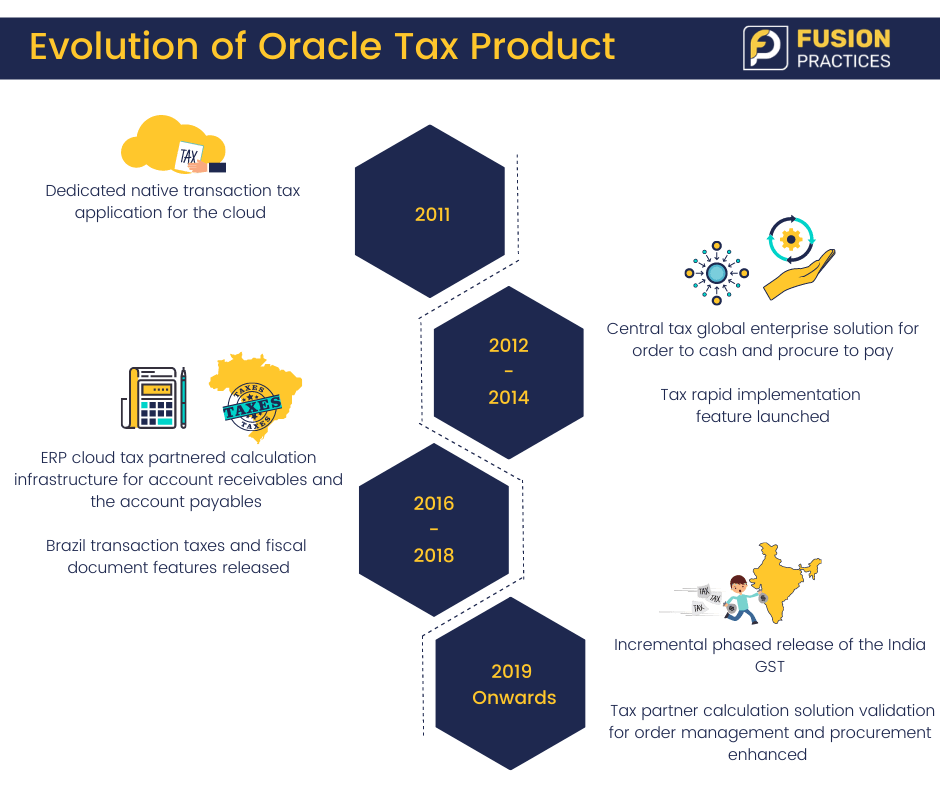

Over the years, Fusion Tax has evolved to keep pace with the business and regulatory changes. In 2011, the dedicated native transaction tax application—Fusion Tax—was available in Oracle Cloud. Later between 2012-2014 central tax global enterprise solution for ‘order to cash’ and ‘procure to pay’ was put into service universally. Furthermore, tax rapid implementation feature was released to drive implementation efficiency. During 2016-2018, tax partnered calculation infrastructure for Account Receivables (AR) and Account Payables (AP) flow was launched, along with Brazil transaction taxes and fiscal document feature. And in 2019, India GST was released in a phased manner and the tax partner calculation solution validation for order management and procurement was upgraded and made available.

Universal tax compliance capabilities for global tax management

Today businesses need to adhere to both global and local tax laws in the geographies that they operate in. And this can be challenging. Oracle Fusion Tax has several features to help companies not only streamline their tax calculation but also comply with the regulatory requirements.

Key among them are:

- Out-of-the-box design that delivers automated tax content upload. This model supports global country configuration as well as tax rules.

- Tax calculation is the normal transaction data that automatically applies relevant taxes where applicable. So, based on the tax rules that are created, taxes are applied. The taxability exceptions and rules can be used to cater to unique business needs.

- Tax results can always be simulated prior to live transaction processing with the help of tax simulator.

- Tax reporting—generic reporting extracts such as the tax reporting ledger are available.

- Standard feature reports such as the financial tax registered, tax audit reports, tax reconciliation reports are also available in Fusion Tax.

- Country-specific reports can also be made available.

- Report extensibility supported to build custom reports.

Fusion Tax Solution Overview

- Centrally manageable, single-point solution for all global tax needs.

- Facilitates global operations, enables immediate and incremental entry into newer markets without having to worry about tax compliances.

- Maximises return on investment by automating tax calculations on procure to pay and order to cash cycle and increases the efficiency.

- Single data module that integrates other modules such as payables, receivables, intercompany, and expenses and facilitates tax calculations on these.

- The configuration and transaction repository enables compliance. This, as stated previously, is a single source of truth for configuration and reporting as well and offers total flexibility.

- Fusion Tax is a total flexible component. Thus, it is an automated import.

Key transactions and integrations supported by Fusion Tax

- Domestic and cross-border transactions

- Outbound and inbound consignments

- Intercompany transactions

- Internal material transfer

- Global procurement transactions

- For India, bill only and ship only transactions are available

- Advance receipts

- For EU countries, it supports

- Imports, intra-community, domestic purchases and

- Exports, intra-community, domestic sales

- Fully integrated with Fusion ERP

- Seamless order to cash and procure to pay integrations

- For Brazil, fiscal document integration is available

- For India, tax fiscal document integration is available

- Facilitates import of external transactions to Tax Repository for tax calculation, recording, accounting, and reporting for the following event classes:

- Purchase and sales transactions

- Purchase and sales journals

Key features supported by Oracle for transaction taxes and withholding.

For Transaction Taxes and Withholding

- Compounding taxes, tax on tax

- Product-based tax rates

- Quantity-based tax rates

- Oracle supports multiple registrations for first and third parties and validate registration feature is also available within the module (validation incorporated for more than 35 countries)

- Product and party classification schemes are also supported

Specific to Transaction Taxes

- Self-assessed taxes or reverse charges are supported

- The configuration of tax point basis and date

- Deferred recovery for domestic purchases (India)

- Recovery for Imports (India)

- For Brazil, taxable basis formula based on Value Addition and Price Thresholds are supported

Specific to Withholding Taxes

- Choice of invoice or payment-time withholding

- Taxable or tax amount threshold by period, supplier, or product classification

- Choice of Including transaction tax amounts in withholding base

- Automatic generation of tax authority invoices