IFRS 17 – Insurance Contracts

Level of Aggregation

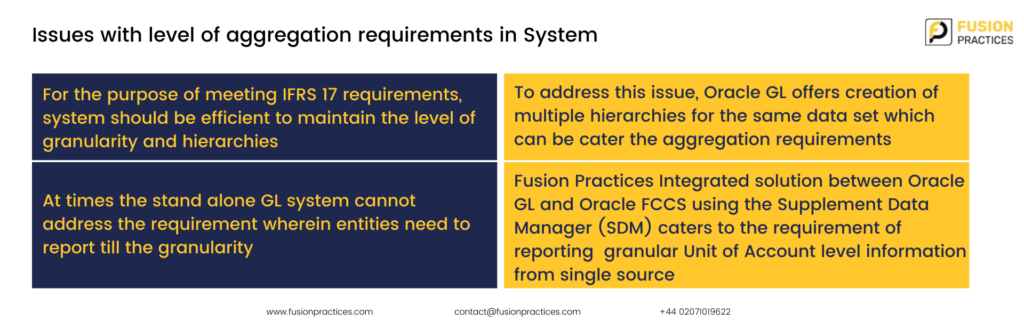

IFRS 17 will transform the quality of reporting, make the insurance sector more ‘investible’ and improve communication between insurers and their investors. The level of aggregation required is not a challenge but an opportunity for clear and transparent accounting. Fusion Practices’ Integrated solution between Oracle GL and Oracle FCCS using the Supplement Data Manager (SDM) caters to the requirement of reporting granular Unit of Account level information from a single source.

The nature of the insurance business exposes insurers—and investors in insurers—to many risks. It is well-known that the financial health of insurers impacts global economy—reason why the financial statements of insurers need to reflect insurance risks and changes in those risks, in a timely and transparent way.

LEVEL OF AGGREGATION – Unit of Account (UoA)

Why is the ‘level of aggregation’ of insurance contracts an important aspect under IFRS 17?

Level of Aggregation affects:

- Allocation of Contractual Service Margin (CSM) to insurance revenue, and the level at which onerous contracts are identified.

- The overall presentation of financial performance of the entity.

There is a view that the introduction of Unit of Accounts for IFRS 17 reporting introduces a lot of complexity and additional processes. However, when we implement Oracle General Ledger in Cloud, we address this from the outset by designing GL Chart of Accounts taking Unit of Account into consideration. Further, the automated accounting rules in Accounting Hub Cloud Service (AHCS) can be designed keeping the Unit of Account in mind so that GL has this segment fully available for reporting. In addition, the processes for further downstream GL activities such as adjustments, expense allocations, and deferred acquisition can be designed taking Unit of Account into consideration.

The UoA has to be captured in the entire data journey from source systems such as policy administration, claims management, revenue management, and reinsurance for GL to work optimally for Unit of Accounts disclosures. The data accuracy in this case can be achieved by designing integrations at right level of granularity into your Data Hub platform.

Insurance companies issue a number of similar contracts to reduce risk known as pooling of risk. Insurers issue a large number of insurance contracts knowing that some contracts will or may result in claims and others will not. In some areas of insurance, all contracts will result in claims, but their timing is uncertain (for example, life insurance.)

In most of the cases, IFRS accounting standards recognise and measure the financials on the basis of individual contracts. For example, IFRS 15 recognises revenue from contracts with customers. However, due to the complex business structure of insurance companies, recognising and measuring financials on contract-to-contract basis is not possible. For this reason, the International Accounting Standards Board (IASB) has introduced IFRS 17 guidelines for contract aggregation for purposes of the calculation and adjustment of the Contractual Service Margin (CSM). These guidelines allow the use of a Unit of Account that is higher than the individual insurance contract.

What is the purpose to be achieved by IFRS 17’s requirement for the level of aggregation?

- Identification of onerous contracts at an initial level, rather than obscuring them by offsetting the losses against profitable contracts.

- Create comparability of profit recognition across the industry and between insurance and other industries.

- Identification and closure of open portfolios on a timely basis.

- Systematic allocation of CSM over the coverage period resulting in meaningful profit trends.

IFRS 17 requires insurers to aggregate insurance contracts into groups according to three criteria:

- Product portfolio

- Degree of profitability

- Year of issue

Let us try to understand each of these in detail:

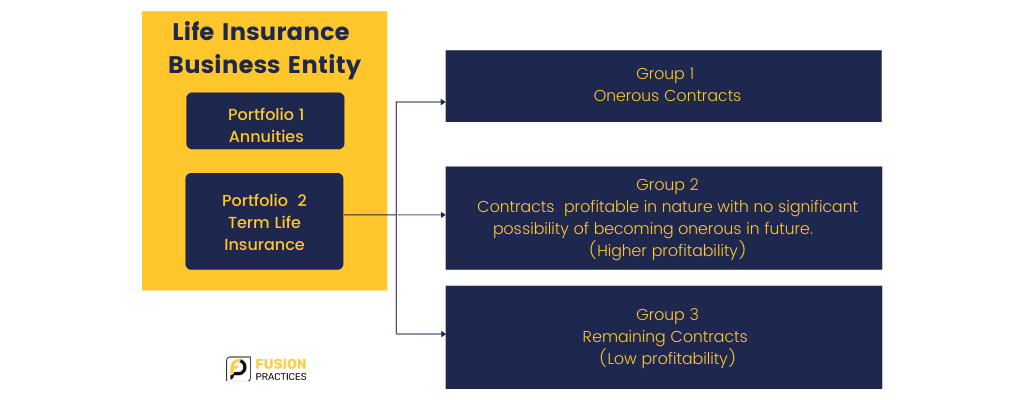

Identify portfolios of insurance contracts

Insurance companies with similar risks and which are managed together will form part of a particular portfolio. Contracts within a product line would be expected to have similar risk and being managed together and thus form a part of same portfolio. Examples of different product lines resulting into different portfolios include (a) Life insurance (b) Annuities (c) Car Insurance

Classification of contracts into groups on the basis of degree of profitability into

- Onerous contracts at initial recognition.

- At initial recognition, no significant possibility of becoming onerous

- Remaining contracts in the portfolio

Year of issue

IFRS 17 requires a portfolio of contracts to be divided into annual ‘cohorts’ or ‘time buckets’. As a result, group may not include contracts which are issued more than one year apart. A cohort can be based on an issuing period, which can be less than a year.

The annual cohort requirement relates to the timing of the recognition of the profit in the contract, the CSM, in profit or loss.

The amount of CSM released within each reporting period is based on an average CSM per coverage unit for the group. This reflects the ratio of the service provided during the coverage period to the total projected future service until the last contract of the group matures.

Let us take an example of a group with one contract having its duration as 5 years and a total CSM of $200. If its coverage units are represented as 5, then the CSM will be released evenly at the rate of $40 over the coverage period.

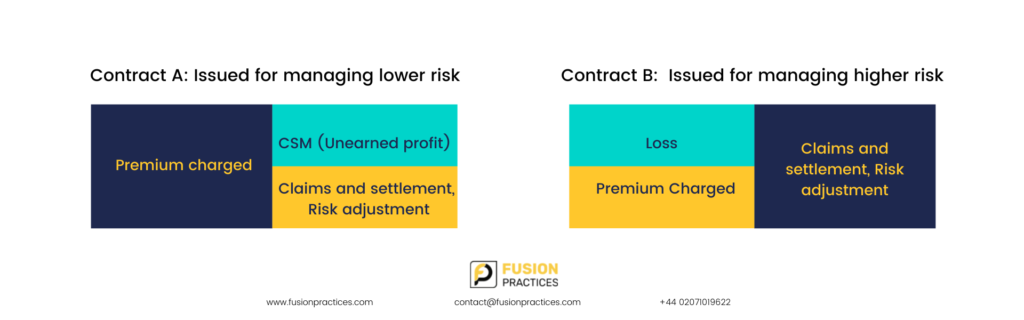

Degree of profitability and size of groups of contracts

Contracts are considered to be onerous at initial recognition, if the cash flow arising from the contract is a net outflow. Under IFRS 17, profits are treated differently from the losses. Profits are recognised over the period of the contract – as and when the entity provides services over the coverage period. Losses are recognised immediately, thus in case of onerous contracts CSM is zero and losses are recognised.

In the above cases, Contract A is a profitable contract and Contract B is onerous. However, in case of contracts restricted by law and regulations, where the entity is required to keep the premium low for managing higher risk, IFRS 17 allows the entity to include both the contracts in same group.

If contracts are not onerous, they are considered profitable, even if different groups will have different levels of profitability.

For the purpose of understanding, let us assume that an insurance entity issues 20 contracts having one coverage unit each. These contracts contribute CSM ranging from $1 to $20. Following the IFRS 17 level of aggregation requirement, these contracts are aggregated into two groups, Group 1 (low profitability contracts) which has CSM contribution from $1 to $10 and Group 2 (higher profitability contracts) which has CSM contribution from $11 to $20.

IFRS 17 works on averages for CSM calculation of a group. Why does it calculate CSM on average basis?

Total CSM (Profit) for Group 1 = (1+10)/2 = $5.5

Total CSM (Profit) for Group 2 = (11 + 20)/2 = $15.5

Total CSM for all the 20 contracts = (1 + 20)/2 = $10.5

Working with averages allows an entity to avoid calculation and de-recognition of CSM balances at individual contract level. An insurance entity issues multiple contracts over the business period and imagine the tediousness of work involved if CSM is to be calculated on individual contract level. Thus the average approach is recommended.

If a contract is de-recognised earlier than expected, working at contract level would require an entity to modify the CSM by adjusting the fulfilment cash flows of the specific contract. Since individual contract CSM calculation and reporting is operationally costly, the standard allows for grouping. Grouping allows an entity to de-recognise the contract from the CSM by using an average at the moment of de-recognition.

It is time to implement the standard – IFRS 17

One of the objectives of IFRS 17 is to make the financial statements of insurance companies clear and easy to understand. Owing to the complexities of insurance accounting, many investors consider that it is accessible only to specialists and even then does not satisfy their needs. It has been acknowledged by many stakeholders that IFRS 17 will transform the quality of reporting, make the insurance sector more ‘investible’ and improve communication between insurers and their investors.

Issues with level of aggregation

- The level of granularity in IFRS 17 which is detailed, may increase complexity in terms of data volumes.

- Applying the annual cohorts’ requirement would require significant changes to systems and increase costs.

- Applying IFRS 17 will affect how onerous contracts are identified compared to current practices, and may also affect the pricing of some contracts.

Conclusion

The level of aggregation of CSM calculations should reflect the true economic nature of the underlying groups of insurance contracts. The level of aggregation should be designed according to the data available, and associated to the characteristics of the policies that will make the analytics meaningful over the final CSM results. In conclusion, the optimal level of aggregation of CSM calculations depends on the types of insurance policies and availability of data to produce useful analytics of contract groups.

Author: Priyal is a Consultant at Fusion Practices.