IFRS 17 Insurance Contracts

Using Oracle Cloud to meet Disclosure Requirements

IFRS 17 is expected to significantly impact the presentation and disclosures included in the financial statements of insurers. Fusion Practices’ solution uses Oracle cloud to help insurers combine their financial data from General Ledger and non-financial data, validate and reconcile them for a better analysis and accurate reporting.

The New IFRS 17 Disclosures

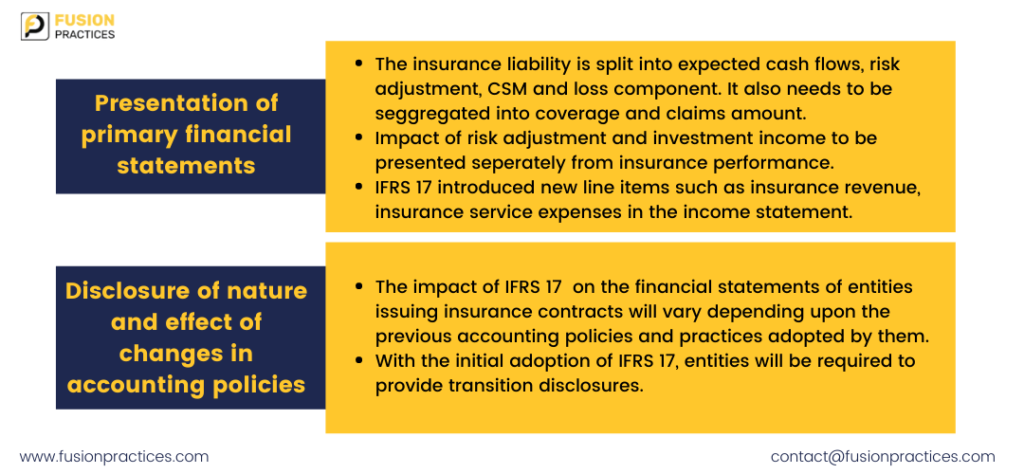

Insures are required to disclose information regarding the balance sheet, income statement, changes in equity, cash flow statement, and additional explanatory details in their notes to accounts. These disclosure details provide information that forms the basis for decision-making for the users of the financial statements who assess the effects of the contracts within the scope of IFRS 17. New disclosures include detailed reconciliations of various components of insurance contract liabilities and confidence level reporting of carried reserves. Hence, IFRS 17 is expected to significantly impact the presentation and disclosures included in the financial statements of insurers.

While there is a significant amount of disclosure information that is derived from General Ledger (GL), there are several elements of information that you will typically not have in your GL. As a best practice we have been helping our customers implement Oracle EPM’s Narrative Reporting and FCCS to combine the Oracle Fusion Cloud GL and non-GL information for producing disclosures that are consistent with the regulatory submissions and with an organisation’s internal MI. Further, as IFRS17 reporting increases the need for reconciliations, several of our customers have benefitted from using Oracle EPM Account Reconciliation Cloud Service (ARCS) for such reconciliation and controls.

IFRS 17 contains more extensive and detailed disclosure requirements as compared to IFRS 4, and requires insurers to provide both qualitative and quantitative disclosures about the insurance contracts within its ambit. The disclosures are to be given in below mentioned areas:

- Explanation of the recognised amount

- Significant judgements made in applying IFRS 17

- Nature and extent of risks that arise from contracts within the scope of IFRS 17

For the purpose of meeting the disclosure requirements, the standard allows the entities to exercise judgements in determining level of details necessary, so that the useful information is not obscured due to too much detailing of information. Further, IFRS 17 includes examples for aggregation, which are as follows:

- By type of insurance contracts (For example, life insurance, property and casual, vehicle insurance)

- By geographical area (For example, regions such as Asia, Europe, Middle East, or country)

- By reportable segments (IFRS 8)

The section brings a list of some of the new disclosure requirements as per IFRS 17 and the Oracle solutions offered by Fusion Practices:

|

Reference |

Disclosure requirement |

Oracle Solutions offered by Fusion Practices |

|

Para 104 of IFRS 17 |

Provide information about the contractual service margin as a part of the reconciliation from the opening to closing balance of the insurance contracts. The reconciliation shall be on the following basis: – changes that relate to future services – changes that relate to current service

|

To meet the disclosure requirement: 1. Multiple COA hierarchies can be created using EDMCS 2. Creation of accounting rules for Oracle sub-ledger using AHCS 3. As a part of reconciliation requirement from the opening to closing balance, it can be achieved by using Oracle FCCS |

|

Para 109 of IFRS 17 |

Insurers are required to disclose either quantitatively or by giving qualitative information as to when they expect to recognise the contractual service margin remaining at the end of the reporting period in the profit and loss. |

The disclosure requirement involving qualitative and quantitative reporting can be met with using Oracle Cloud EPM Narrative Reporting. |

|

Para 117 of IFRS 17 |

Entity is required to disclose the methods used to measure the insurance contracts and the process used for estimating the inputs to use the methods. |

The disclosure requirement involving qualitative and quantitative reporting can be met with using Oracle Cloud EPM Narrative Reporting. |

|

Para 117(c) of IFRS 17 |

Entity is required to disclose the methodology to: – determine the risk adjustment for non-financial risk – determine the discount rates – determine the investment components |

Oracle FCCS using Supplemental Data Manager (SDM) can achieve the purpose of disclosure of methodologies for determination of risk adjustment, discount rates etc. |

Fusion Practices Limited provides a one-stop solution that automates the existing actuarial and accounting models. Click here to download a detailed whitepaper to know how we enable an end-to-end reporting from policy systems to disclosures using Oracle Cloud.

Author: Priyal is a Consultant at Fusion Practices.