Fusion Tax – Regime to Rate Flow

Oracle Fusion Tax provides you with a single interface for defining and maintaining the taxes that you are subject to in each country where you do business.

Oracle Cloud Financials tax enables you to set up tax regimes for taxes in each country and geographic region where you do business and where a separate tax applies. Tax regime associates a common set of default information, regulations, registrations to one or more taxes with the same tax requirement. The common tax setup is one tax regime per country.

What is Tax Regime?

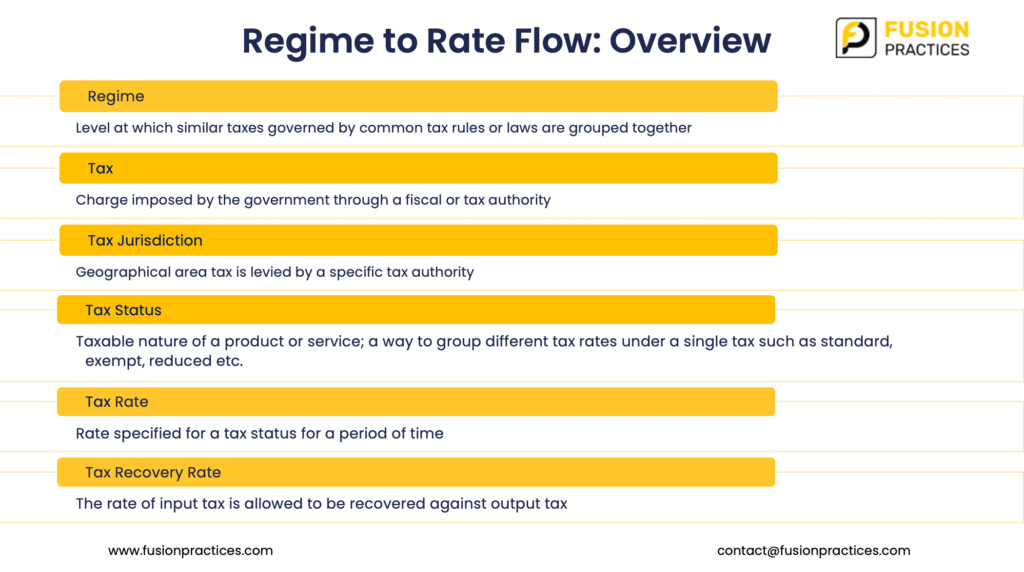

Tax is typically defined as a charge imposed by a government through a fiscal or tax authority. Tax regime is a level at which similar taxes governed by common tax rules or laws are grouped together. This means there are country-specific regimes. Under each regime, there is a regime to rate flow.

In addition to tax, there are other aspects such as:

- Tax jurisdiction: geographical area tax is levied by a specific tax authority.

- Tax status: the taxable nature of a product or service such as standard, reduced, exempt, and zero rated.

- Tax rate: the percentage of tax that would be applied for a particular transaction. The tax rate can be a defined percentage or quantity-based tax rates which can also be defined.

- Recovery rate: the rate of input tax that can be recovered against output tax. It is an optional setup based on business requirements.

Fusion Tax Rules Concept

In Oracle Cloud Financial Tax, the regime to rate flow represents the default tax setups that are done to achieve simple business requirements. However, to achieve complex business requirements tax rules can be defined, which will always take precedence over default setups.

Organising the Tax Requirements

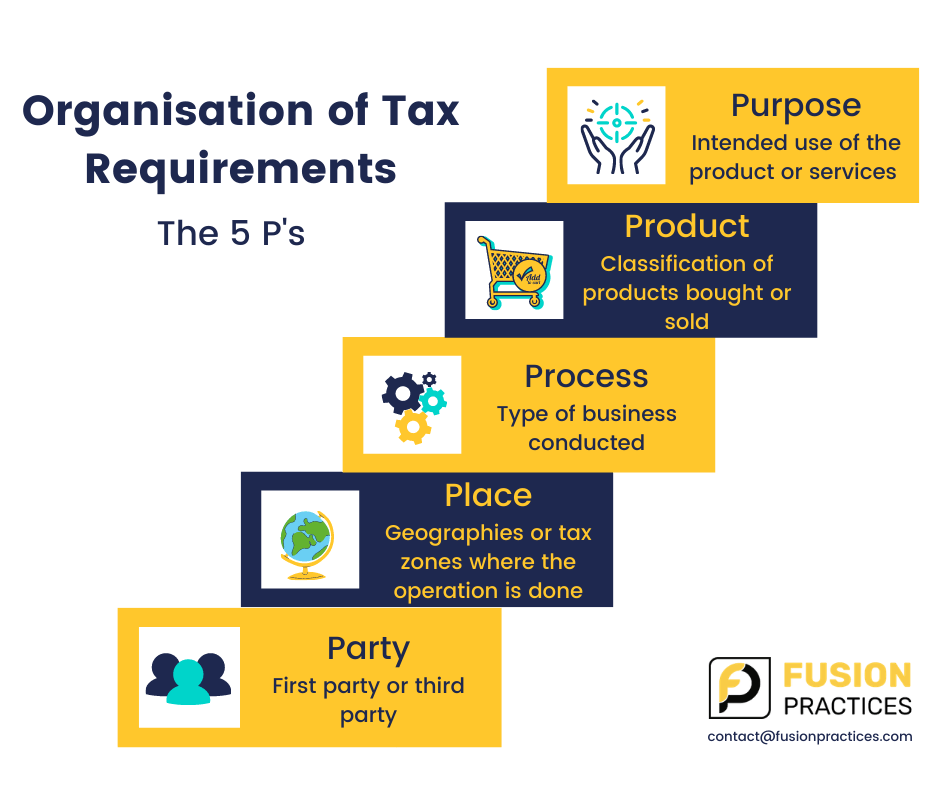

The normal transaction data derives the global tax determination process:

Party

- First Party: Who am I and what are my tax obligations – A corporation, government, an exempt organisation, or a consumer servicer.

- Third Party: Who are my customers and suppliers – Large/small scale, importers, exporters.

Place

The countries or locations from which the business operates or buys from or sells into.

Process

Type of business that is conducted – manufacturing concern, trading activities, services.

Product

Kinds of products the business deals in – tax determination can be done based on products.

Purpose

The intended use of the product or services that we buy – consumed, used in further production, or reselling.

How does the rule engine analyse the tax rule?

Scenario 1

Requirement – For Tax Applicability. If bill from party’s country is equal to France, then a particular tax is applicable.

In this scenario the ‘bill from party’s country’ will be the determining factor, ‘equal to France’ will be a condition factor, which is based on the determining factor. The result for this would be ‘tax is applicable’ which is called the final result.

Therefore, whenever system finds bill from party’s location as France, it will calculate the applicable tax. However, if these conditions are not fulfilled, then system will apply the default rules and tax will not be applied.

Scenario 2

Requirement – Automated calculation self-assessment tax

- Self-Assessment tax is also known as reverse charge or offset tax in some countries. In this scenario, supplier tax is not levied by supplier but the receiver/purchaser of goods is liable to pay tax. Common scenarios are import or purchase of goods from unregistered suppliers.

In this scenario, the rule basically works on the registration status of supplier. The first step is to define the registration status of the first and third parties. (In case of import of goods, the supplier will not be registered in the country of the receiver and therefore will be treated as not registered).

Tax Registration Rule -A tax registration rule will be set up i.e. ‘bill from party’s registration status’ will be the determining factor and ‘not registered’ will be the condition factor based on the determining factor and the result would be ‘Bill to Party’.

Therefore, whenever the system finds the bill from party’s registration as not registered, it will apply the registration status of bill to party and self-assessment check box is enabled and checked. However, if the above conditions are not fulfilled, then the system will apply the default rules and bill from party’s registration will be considered.

Scenario 3

Requirement – Compounding of tax.

In simple terms compounding means tax on tax. Suppose we have two taxes, T1 and T2, that are applicable on a transaction and T2 is applied on the invoice line amount plus the T1.

In this scenario, taxable amount for T1 – Invoice line amount and Taxable amount for T2 – Invoice line amount plus T1. A regime to rate flow is setup to fulfil the compounding tax setup requirement in which compounding precedence plays a key role. Based on the compounding precedence only, the taxes and tax formula are evaluated. The tax with the lower compounding precedence is evaluated and calculated first and then the tax with the higher compounding precedence is considered.