How to solve incorrect calculation of the pre-tax amount in Oracle Advanced Benefits

In some calendar years, the total number of periods (bi-weekly or weekly) vary based on the holiday coming on the last or first day of the year. Due to this, the payment date in Oracle Cloud Payroll is shifted to next year, and subsequently, the configuration changes in the benefit deduction also vary – which causes problems in employees’ paycheck.

When Benefit elements (pre-tax classification) get processed in payroll, it deducts an incorrect amount, causing all the employees to get overcharged on benefits, which causes problems in employee paychecks and in maintaining balances and all the reporting to government in payroll.

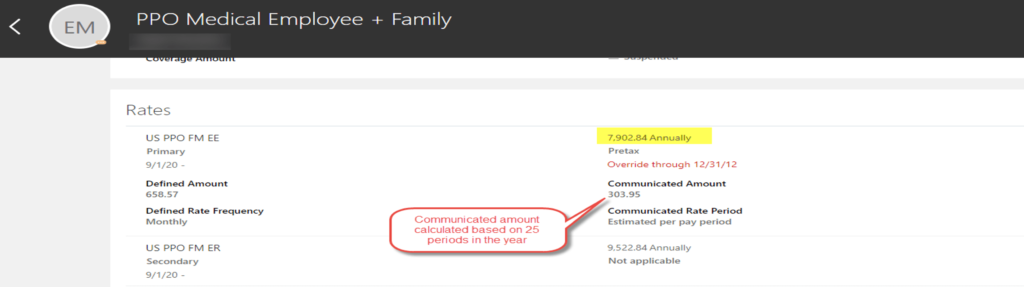

As shown in the below screenshot, employee contribution is overridden to 303.95 which is the correct calculation = 7902.84/26

However, the system is calculating: 7902.84/25 = 316.11

Root Cause

While defining rates in Oracle Advanced Benefits (OAB), there is a setting to pass the value in payroll. For example, if we have monthly payroll then the deduction per month would be Annual Rate/12.

But when the payroll period is weekly or bi-weekly, then the period within the year varies based on time period defined in payroll. There can be 52 or 53 weeks in a year.

Bi-weekly period can also be 25, 26, or 27, based on the payroll period defined.

For example, if a person has 1200 as annual contribution, then:

- Monthly contribution is = 1200/12 = 100

- Weekly can be 1200/52 or 53

- Bi-Weekly can be 1200/ 25 or 26 or 27

To avoid this difference in calculation, we have to change the rates configuration as per the requirement by using below options.

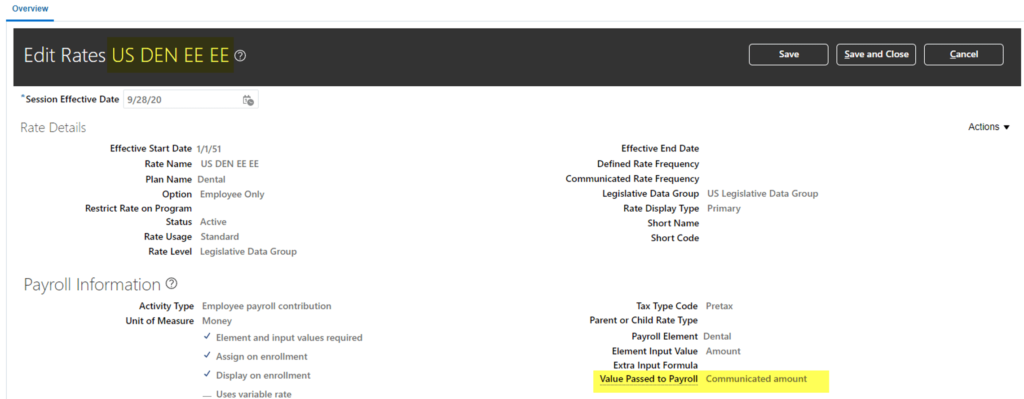

Value Passed to Payroll:

In the Value Passed to Payroll field on the Create or Edit Rates page, select the amount that you want to pass to a participant’s payroll element entry on enrollment.

Your choices are:

Communicated amount

The amount that the participant is told to expect for their contribution or distribution.

Defined amount

The amount that is defined for the rate, which may be different than the amount communicated to the participant.

Estimated per-pay-period amount

An estimate based on a fixed number of pay periods. For example, a bi-weekly payroll might occasionally have 25 or 27 pay periods in a calendar year, depending on the setup. Likewise, a weekly payroll might have 51 or 53 periods. When you select this option, the calculation uses the usual number of pay periods, which would be 26 for bi-weekly or 52 for weekly.

Per-pay-period-amount

The actual per-pay-period amount is based on defined calculations. If you do not select a value, the calculation uses the per-pay-period amount. You can prorate only per-pay-period amounts.

Annual amount

The defined amount annualised.

In this case, the issue is that the amount is getting calculated by considering the bi-weekly pay period 25 in the year 2020, so all the employees getting hired/rehired are getting the benefit contribution calculation based on 25 periods – leading to the employees getting overcharged. This happens because of the below configuration.

Solution -To get a fixed calculation for all the employees irrespective of joining year and payroll period in that year, we have to choose the option ‘Estimated per-pay-period amount’.

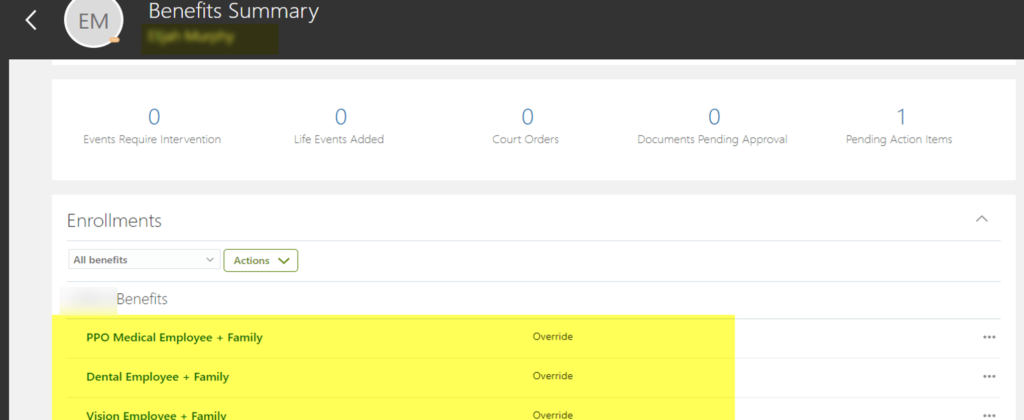

Once you change the configuration to ‘Estimated per-pay-period amount’ you get the expected results. This solution will only work on the person getting enrolled post these changes, other impacted employees’ contribution can be corrected by using override enrollment option in benefit service center.

Author: Nitin is an Oracle HCM Solution Architect