How Oracle Revenue Management and Billing (ORMB) helps organisations improve efficiency

Delinquency Control Management through ORMB can help companies overcome the losses due to late payments, thereby averting the risks that are associated with these accounts and increasing the percentage of profits including the operational ones that are acquired from these.

What is delinquency?

Delinquency can be termed as a failure to follow certain rules which are governed by law, regulation, or agreement. In the world of finance and investing, it mainly occurs when a person or company with a contractual agreement, fails to pay– for a particular job or defaults on loan payments such as paying debt or bond interest– on time or from time to time. It also occurs when an investment professional fails to perform duties expected of them by the customer.

What are the consequences of delinquency?

- Late payment fee in case of delayed EMI payments

- Possession of the property in case of Mortgages.

- Policy lapse in case of late premium payment

- Penalty levied in case of late payment of taxes.

What is the difference between delinquency and default?

Delinquency and default both are related to late payment of loans. However, it is delinquency when the payment of the loan is delayed, and it is considered as default when the borrower repeatedly fails to meet the loan payments.

To know more about Fusion Practices’ Oracle Implementation Services

What are the indicators of delinquency?

Delinquency is measured because it shows the risks that are associated with the profile of the borrower. It alerts the operational team and can help predict the amount lost in the particular portfolio at the end due to non-payment.

There are many types of overdue indicators:

- Recovery rate measures the amount actually paid for the amount that has reached maturity.

- Risk-rate portfolio measures the outstanding amount of loans not paid in time against the outstanding balance of the total loan.

Impact of delinquency on microfinance businesses

Microfinance institutions (MFI) are firms that lend low-value loans to consumers.

For instance, let us assume that the repayment of the loan given by the company to its customer is delayed. As a result, the MFI will lose the income from interest charged on the subsequent loan. The interest charged on these loans is the income required for the MFI to carry out its day-to-day operational activities. For each credit lost, many extra modern loans must be made to create sufficient income to replace the lost loan capital. In general, financing companies require a proper management tool for keeping track of the data, send updates to their customers for timely payments, and also establish proper policies in case of delinquency. This makes a business case to introduce Oracle Revenue Management and Billing (ORMB) to provide proper delinquency control.

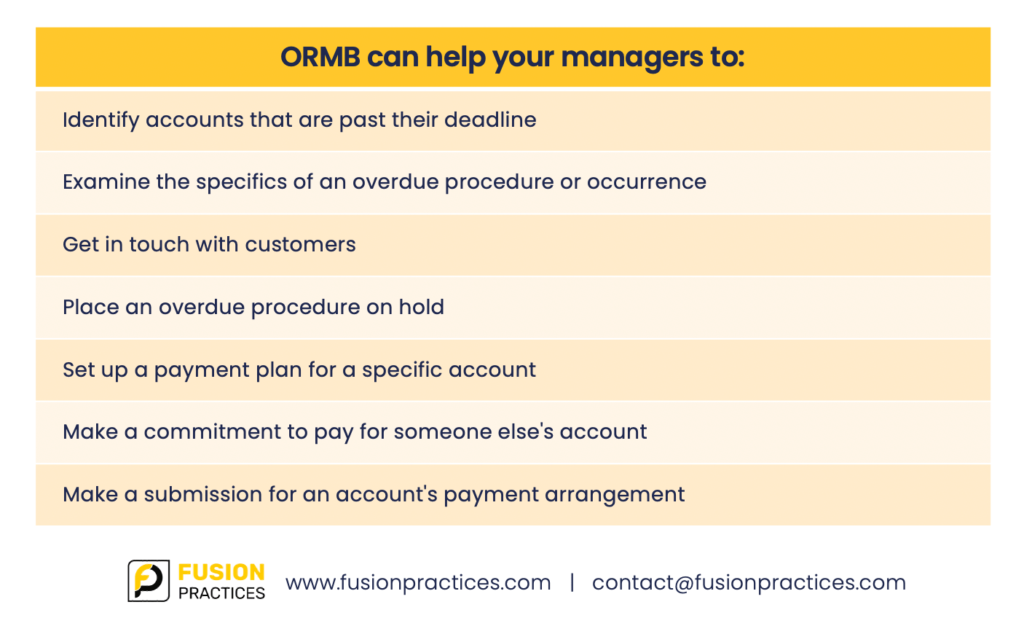

How does ORMB help you control delinquency?

The ‘delinquency central’ feature in ORMB helps you to distinguish every delinquent account process using an ‘overdue monitoring process’, which helps for timely tapping of delinquent accounts and also gives a proper overview for tracking the same. Thus, by having this feature it can help companies to overcome the losses due to late payment, thereby averting the risks that are pertained from these accounts and also to increase the percentage of profits including the operational ones that are acquired from these.

Author: Vidhya Venugopal is a Functional Consultant with Fusion Practices