Introduction

Oracle Cloud provides a full Credit to Cash solution which will help the Customer improve cash flow, increase efficiencies, optimize customer relationships and instil corporate and fiscal discipline according to Modern Best Practice processes.

Oracle Cloud Receivables provide a comprehensive solution for running day-to-day accounts receivable operations. It includes a host of services for customer billing and payment activities, revenue recognition, and adjustments, accounts receivable balances, and reconciliation to the general ledger. Oracle Cloud introduces Smart Receipts, an industry-leading automated cash application solution.

Having analysed the Customer’s requirements over multiple projects delivered, we recommend having the following modules implemented within Oracle ERP Cloud:

- Oracle Fusion Account Receivables – For customer management, Invoicing and Receipting process

- Oracle Fusion Advanced Collection – For efficient monitoring collections and manage debt recoveries

- Fusion Practices’ Direct Debit Solution – To automate collection process using direct debit

The above-mentioned modules will enable the customer with Functionalities which help to achieve a smoother and more efficient process for their Accounts Receivables and Recoveries. Some of key functionalities we have identified from the modules suggested are –

Customer data

Oracle Cloud incorporates an embedded Customer Data Model which is extremely flexible and ensures that the Customer can properly record and account for income transactions, as well as all other attributes of your customer relationships

Customer information can be created either through the application user interface, through integrated spreadsheets for bulk entry, or imported via Integration with another cloud / on-premise solution.

Invoices

Oracle Cloud provides flexible ways of having customer invoices into the system. It can either be imported through external systems by way of integration, upload using a spreadsheet, or can be created manually.

Accounting of these invoices can be automated using Auto Accounting functionality with Oracle Cloud. Based on transactional data for the customer receivables can automatically derive the right account code for each of the segments of the Chart of Accounts.

Correspondence

The standard configurable feature is available within Oracle Fusion Receivables to generate periodic customer statements and email/print periodically for each customer. required copies or all the correspondence with customers can be generated.

Debt and Debt Recovery

Oracle Fusion Advanced Collections empowers you to collect money faster with less effort through streamlined processes that apply the best collections methods to customers to enable you to manage collection risk

It shows required information on interactive dashboards for details and real-time information. Collectors can view ageing by transactions. Ageing buckets can be configured as per the council’s requirements

Maintaining Direct Debit Mandates

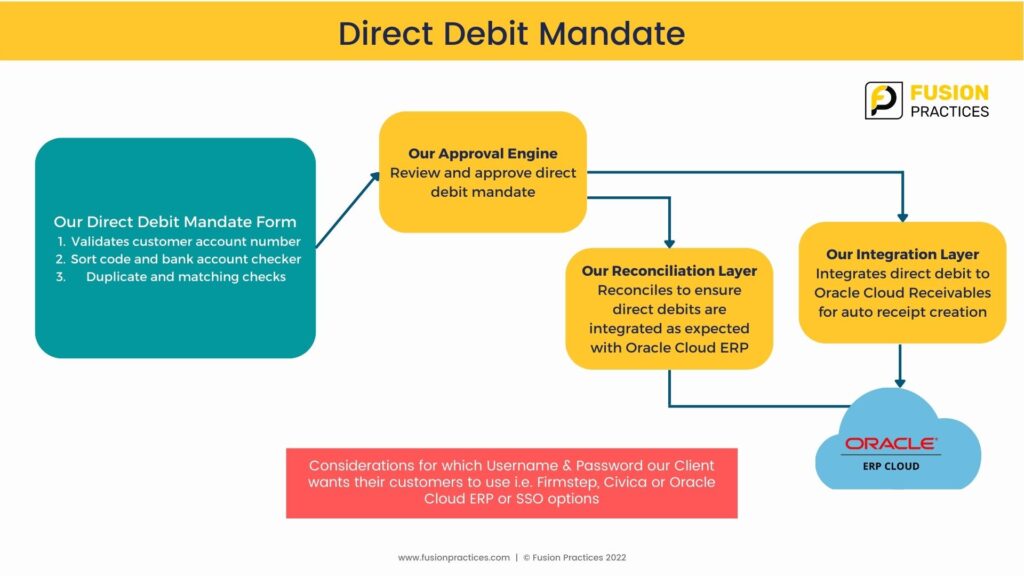

There are multiple ways a customer can capture Direct debit information whereby either the customer can use Fusion Practices’ mandate capture form or use Civica hosted form or use Firm step hosted forms.

Once the information is captured and approved for direct debit mandates, Oracle Cloud Integration services would add/update the customer bank account record in ERP Cloud.

Direct Debits & Receipts

Oracle Fusion Account Receivables offers multiple ways to create receipts, for ex: manual receipt from UI, creating a receipt by integration, or creating automated receipts such as direct debits

With the automated receipts functionalities, a direct debit method can be created in receivables which would create receipts automatically.

Reports

Oracle ERP Cloud’s reporting tool can meet all the requirements for transactional reporting.

There are set of transactional reports like customer statements, ageing reports, invoice templates, etc. already available as standard. These reports can also be customized as per the customer’s requirement