Payroll Reversal Process in Oracle HCM Cloud

Oracle HCM Cloud enables you to not only run a payroll, conduct post-processing on a successful payroll but also rectify incomplete and erroneous entries using its reversal function. Our experience in implementing Oracle Cloud Payroll tells us that we need to design for payroll reversal scenarios from the outset.

Payroll processing is an intensive function and at times can be subject to inadvertent errors. A few typical scenarios are described below:

Scenario 1: During the payroll run an employee’s compensation is incorrectly credited and is also transferred to the employee’s bank account. Later, though the employee refunds the same to the organisation, the post-process has already been completed in the system and rolling back the process is not possible.

However, it is essential to rectify the calculation even if the payment is already refunded as it will have an impact on the employee’s tax liability. Moreover, it will also cause reporting issues in finance, W2, and other year-end reports.

Scenario 2: Incorrect entry of employee bank account in the system leading to the salary being credited to the wrong account.

Scenario 3: Voiding cheques that have been issued incorrectly.

Is it possible to rectify these issues is a question that many may have? Yes, these can be resolved with a reversal at the payroll end including knocking off the entries. Reversal process can also be used when the option to roll-back the process is no longer available as the post process has been completed and the entry posted to General Ledger (GL).

Solution–

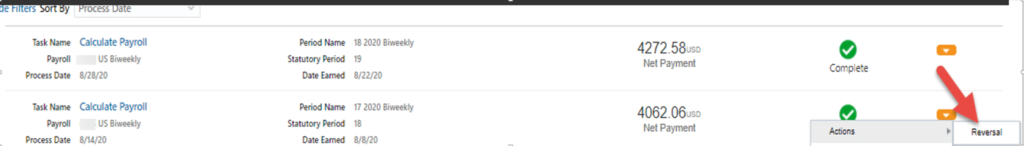

Step 1 -To perform the reversal, go to the payroll that needs to be ‘reversed’ and select the reversal option as shown in the screenshot below.

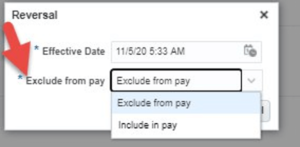

There are two options to process the entries during reversal as shown in the screenshot below. If the ‘Include in Pay’ option is chosen, then the system will reduce this amount during the next payroll process and the money will be deducted from the employee’s paycheck. However, in Scenario 1 discussed above, since the employee has already refunded the money, “Exclude in Pay” is used to ensure that future payroll is not impacted.

We saw how to reverse the payroll and create reverse entries. Now, we will demonstrate how to reverse an already refunded payment in the system and how to reverse the ‘Payment Costing’ in GL.

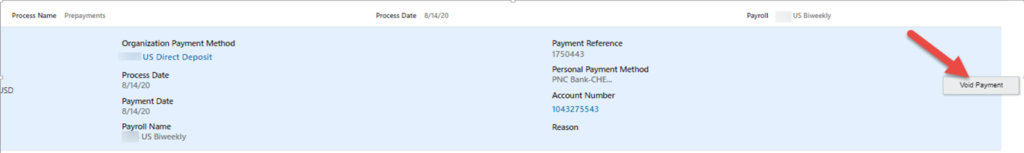

Step 2 – To reverse an already refunded payment in the system, go to the pre-payment process results and select the ‘void payment’ option as shown below.

Selecting this option and providing the date will void the payment. If the process is successful, the ‘VOID’ status will appear on the screen.

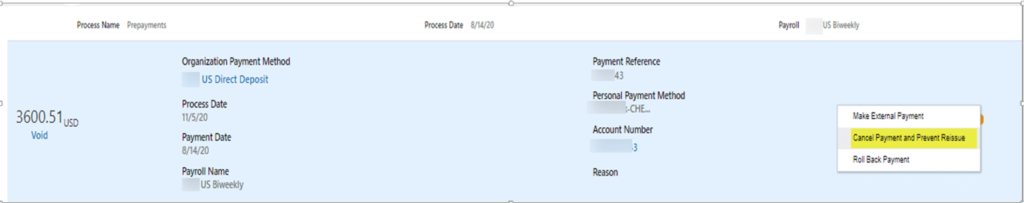

Step 3 – This payment can be cancelled by choosing the option shown below. There are options to cancel and do the external payment through AP (Accounts Payable).

While choosing this option, the effective date and the reason for cancellation of payment needs to be provided. On successful completion of this process, “Canceled and cannot be reissued” status will appear.

Step 4 – At the stage, the payment would have been cancelled in the system as well. So the next step is to run the ‘Costing of Payment’ process to pick these entries. This is required to reverse the wrong payment accounting entries present in the GL.

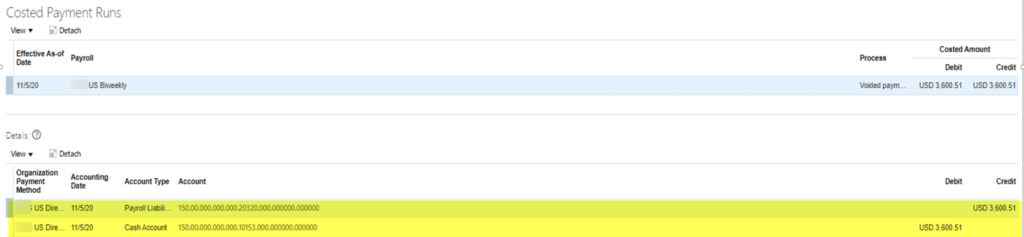

Once the process is completed, the payment costing results as shown below will appear.

As is evident, the amount that was shown as debit previously is now reflecting as credit. This will be carried through to the GL too, and the costing of payment will also get knocked off.