An Introduction to the Multi-currency module in Oracle Revenue Management and Billing (ORMB)

In today’s global market, companies need to conduct business in multiple currencies. For e.g.: -Many countries in the European union use both the euro and their national currencies due which Muli currencies module is a need for every organisation

Why is multi-currency feature required in the banking and insurance sectors?

Multi-currency system refers to accounting software that can conduct transactions in multiple currencies and promote international sales and purchases. In today’s global market, companies need to conduct business in multiple currencies. For e.g.: -Many countries in the European union use both the euro and their national currencies due which Muli currencies module is a need for every organisation. Also, another reason for which we need multicurrency module is globalization and outsourcing of labour, material and resources these countries face the challenge of multi-currency capabilities. Thus, there is a need for creating a currency journal which can re-evaluate foreign currencies and convert them to national exchange rates and report in multiple currencies. Without proper accounting software, multi-currency transactions this task can be cumbersome. Due to which we need a multicurrency module in our organization.

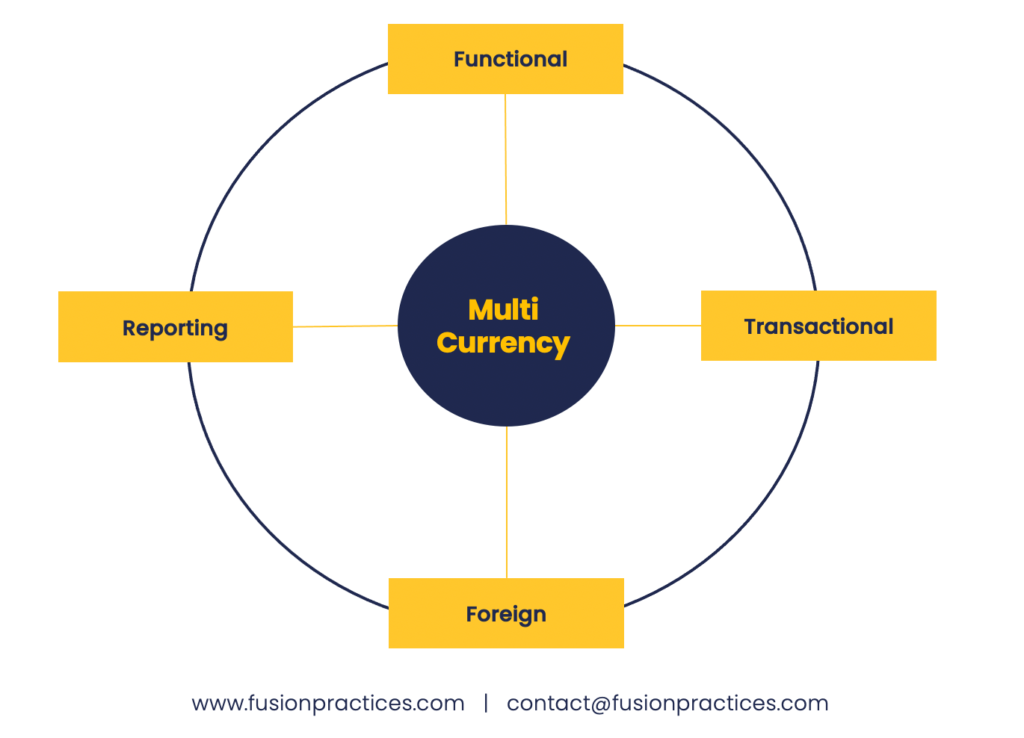

The multicurrency system is required for maintaining the data for the following transactions:

- Lease transaction.

- System that can revaluate transactions (bank accounts) in currencies other than the invoice currency.

- Ability to convert transactions or balances for reporting purposes.

To know more about Fusion Practices’ Oracle Implementation Services

Issues faced by Organization having multicurrency transactions

- General ledger Accounts Revaluation systems not available in case of different currency due to which there is a difficult in finding the currency rate for each transaction.

- Currencies and rates are unlimited it’s hard to find the different rates at the same place and assign the same.

- Reports on history and audit not available in the data easily being provided for a particular currency. A Predefined reports monitor the history, translations and revaluations of the currency rates are required.

- Currency list not being predefined as per the standards.

Features of multi-currency module in ORMB

Oracle revenue management and billing allows you to change the currency in which an account is invoiced. While the charges on a bill must be in a single currency, accounts can now be billed in different currencies over time. For example, when a customer opens an account, it might be billed in USD. However, with the multi-currency accounts feature enabled, the same account can be billed in EUROS in the future.

- You can use the multi-currency accounts functionality only after: you have set the c1_mltcuracc feature configuration by defining the following option types: Allow multi-currency accounts – indicates whether the multi-currency accounts feature is switched on or off. To switch on this feature, set the allow multi-currency accounts option type to y. By default, the value is set to n.

- Currency conversion algorithm – used to specify the name of the algorithm that you want to be used for currency conversion. This algorithm is the same as the one used for currency conversion in billing.

Transfer adjustment type for currency conversion – used to specify the adjustment type that you want to be used automatically when financial amount in one currency is converted to another currency. - Cancel reason code for currency conversion adjustment – used to specify the reason code that must be used automatically when the transfer adjustments are cancelled while reopening a bill

- Payment distribution to-do – used to specify the to do type that you want to be generated when the bill currency does not match the excess credit amount currency. The account’s customer class is enabled for open item accounting. In other words, the open item accounting check box of the account’s customer class is selected.

Benefits of using ORMB for multicurrency module.

- Invoices available as per the currency required in the country.

- One can apply payments in the currency which is different from the account’s invoice currency.

- It can monitor overdue debts.

- Generating history for all the financial transaction done between the party.

Author: Vidhya Venugopal is a Functional Consultant with Fusion Practices