Case Study

Scoping a finance transformation and IFRS17 implementation for a leading UK Insurer

Sector : Insurance

Overview

A major transformation programme for a leading UK insurer wanting to implement both IFRS 17 and a finance transformation simultaneously.

There was a need to implement IFRS17 which required enhanced data capabilities. Opportunity was taken to run as part of a transformation programme to provide additional capability to support the significant growth of the insurer.

Fusion Practices were initially engaged to help structure the programme of work required, propose a transition path and the build the business case.

The business case was approved based on our work. Fusion Practices then went on to help deliver the business case with a mixture of internal resources and with other external vendors.

Business Objectives

IFRS17 compliance

Improve control environment to focus on preventive measures rather than detective measures

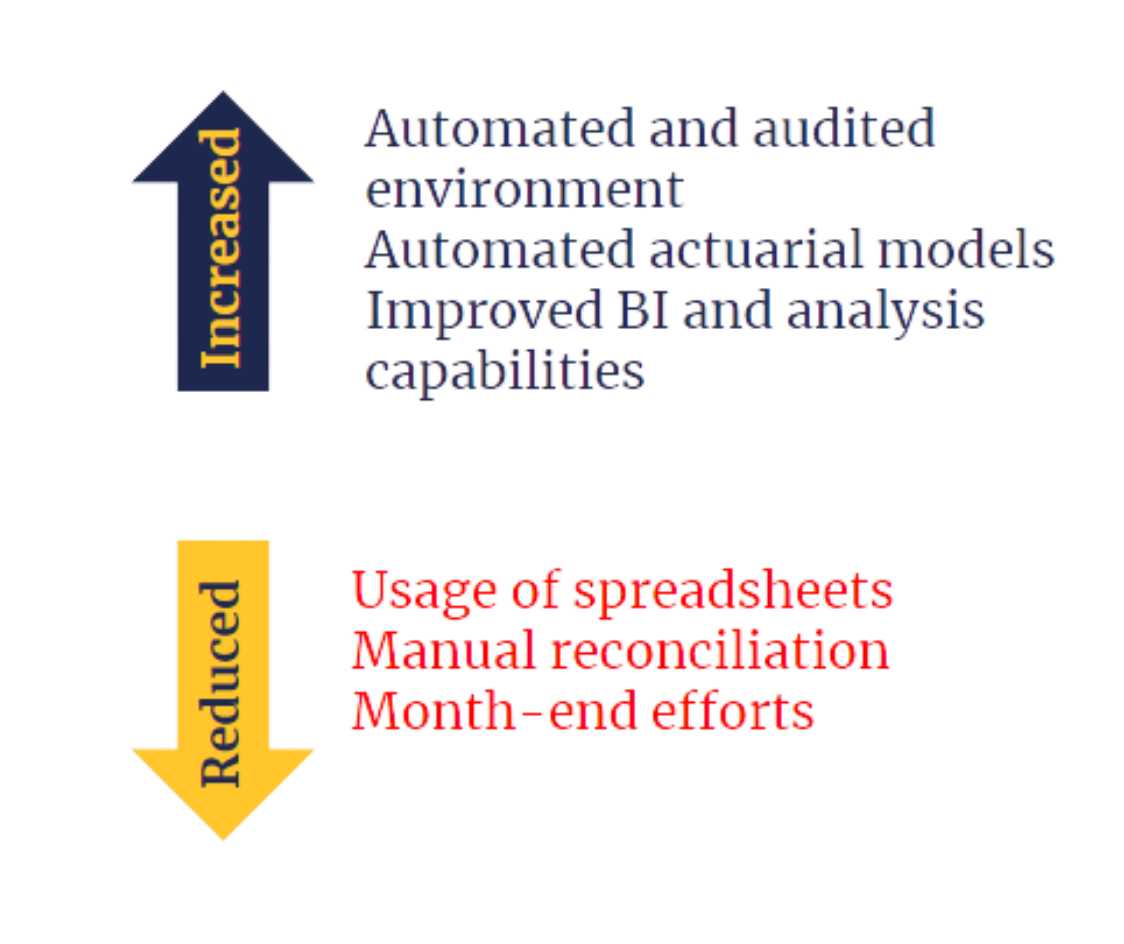

Enhance automation to significantly reduce manual processes and the use of spreadsheets

Scalability to support business growth without significant increases in headcount

Enhance value add activities due to more time being able to be spent on business insights over manipulating data

Solution

Finance Blueprint

- RNew accounting general ledger to support IFRS17 reporting requirements and due to it going out of support within 2-3 years

- RNew accounting general ledger to support IFRS17 reporting requirements and due to it going out of support within 2-3 years

- RTools to be implemented to automate reconciliations and produce key reports.

- RSingle source of data used across finance for reporting and analysis.

- RReporting and analysis tool to deliver standard and self service reports

Business Case

- fBenefits alongside success factors based on programme objectives

- fTransition path with dates

- fCosts per project required and resources

Business Exercise

- Facilitated shadowing exercise of monthend processes which involved a cross section of business, IT and other 3rd party consultancies to understand and propose solutions.

Fusion Practices Achievements

Identified the Finance transformation scope, benefits and expenditure plus the blueprint required to achieve it.

Worked with Actuaries and Accountants to ascertain existing processes, problems areas and improvement needs.

Transition and future states were identified as part of a blueprint artefact

Identified list of projects to meet the transition and future states from the blueprint artefact

Provided detailed understanding of the benefits for each of the projects and the costs including implementation and business change costs.

Set out the communication engagement strategy, project plan and resources.

Jointly presented with one of the big 4 the findings of shadowing exercise and put together a joint plan on how to take recommendations forward.

Impact

- Reduction in month-end effort by 400 person days

- Reduced manual reconciliations by 15%

- Reduced sending emails to manipulate data by 70%

- Reduction in end user spreadsheets by 70%

- 100% Automated management reporting

- 100% of GL transactions sourced upstream

What do Customers value in our partnership?

Our solutions are designed with a

customer first approach

We take care of end-to-end

implementation and offer

comprehensive support service

We are proven, trusted partners of top-tier companies across sectors such as finance, banking, insurance, and retail